W-2 filing requirements for the State of Arkansas - Tax Year 2020

For 2020, the State of Arkansas has mandated the filing of Form W-2, provided that there is a state withholding. When you file W-2 with Arkansas for the tax year 2020, you must attach the transmittal and reconciliation based on the filing method.

When you paper file W-2, you must attach ARW3. In the case of e-filing, no need to attach ARW3. However, the reconciliation form must be submitted regardless of the filing mode.

Form AR3MAR: Employer’s Annual Reconciliation of Income Tax Withheld

Employers in Arkansas should use Form AR3MAR to report the actual amount of Arkansas tax withheld and the net amount of withholding tax actually paid to the state. Employers should also address the tax due, total wages paid, and total employees.

1099 filing requirements for the State of Arkansas - Tax Year 2020

For 2020, all 1099 forms that you file with the IRS must be filed with the State of Arkansas. If no state taxes are withheld, the dollar threshold for filing 1099 DIV and 1099 INT is $100.00. For all other 1099 forms, the dollar threshold is $2500.00. If state income taxes are withheld, filing of 1099 is mandatory regardless of the threshold amount or current residence.

Note: The State of Arkansas does not require any transmittal or reconciliation forms.

1099 Forms Required for the Arkansas State are:

Deadline to File W-2/1099 Forms with the State of Arkansas

The deadline to file Form W-2/1099 is January 31, 2021, for the tax year 2020. The deadline to file Form AR3MAR, Employer’s Annual Reconciliation, is February 28, 2021.

Avoid penalties! File your returns to Federal & your state electronically on or before the deadline.

Note: If the deadline falls on a weekend or federal holiday, the next business day is the deadline.

Form W-2 and 1099 filing deadline -

January 31, 2021

Form AR3MAR filing deadline -

February 28, 2021

Why E-filing solution is the best compared to Paper Filing?

Electronic filing process will be more simple compared to the traditional paper filing. And you don’t have to wait in a long queue. The manual process of filing your tax returns might have the more chances of errors. You can always save your time, efforts, and ensure accuracy while you prefer electronic filing. When you e-file you will be notified about the filing status of your returns with the IRS.

Also if you are in the last minute of the deadline, E-filing is the best method to complete on time & avoid penalties! Start E-Filing Now

How Arkansastaxfilings.info makes E-Filing

Arkansastaxfilings.info provides an easy way to e-file your W-2/1099 Forms to both the Federal and State agencies. From uploading your information to sending copies to your recipients, you can manage everything in one place. You don’t have to switch between different providers to file your employment tax forms, we do it all!

Get started with arkansastaxfilings.info and e-file your W-2 & 1099 in a few easy steps!

Want to mail copies to your recipients?

Sending the Form copies to the recipients is also a main responsibility for the Payers/Employers who are reporting their W2s & 1099s. We take care of this mandate and tedious process by printing & postal mailing the copies to your employee/recipient on time through our print & mail service.

Want to upload all the Form data at a time for employees/recipients or employers/ payers?

Use our Bulk upload feature to upload all your data for multiple employees/recipients or employers/ payers at one instant.

For uploading the information, you can either use your own template with the column values matching our template or download our template and upload it back with the required information.

Want to Correct Errors on the Federal Forms?

Use our correction Forms to correct errors on the previously filed returns and you can also send it to the respective federal / State agencies.

Do you want to file forms for prior years?

We support the filing of W-2 & 1099 with the State of Arkansas for current and prior tax years. You can e-file your tax returns for 2019 & 2018 with us easily.

Want to Access the returns filed?

With our print center, you can view, print, & download your W-2/1099 Forms anytime that has been transmitted to the IRS/state. And if your recipients missed the form copies, you can also send them a copy again.

Want to File your federal employment tax Forms other than W-2/1099?

We at Arkansastaxfilings.info also support the filing of federal employment tax Forms such as 941, 940, 944, 940/941 Schedule R,

1095-B, 1095-C.

Create a FREE account with us and e-file your returns instantly!

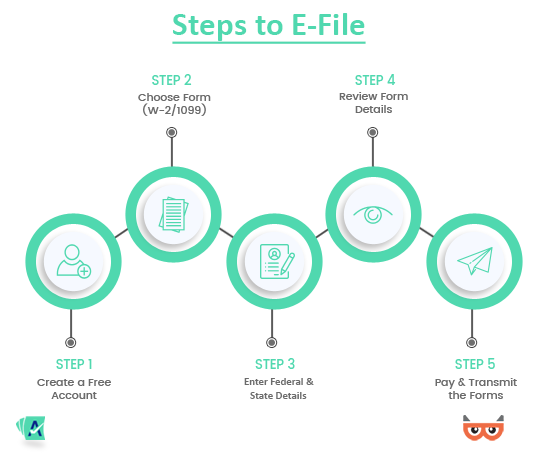

Steps to Electronically File W-2/1099 Forms with the State of Arkansas

See how simple it is to e-file your W-2/1099 returns with our software and begin filing your returns.

- Create Free Account & choose the required Form

- Enter the Employer/Payer Details.

- Enter the Employees/Recipients Details including the Federal and State information like wages, taxes withheld etc.

- Review Forms, Pay and Transmit your returns to the IRS.

Once your returns are filed, we will print and postal mail the copies to your employees/recipients On time without any trouble.

Arkansas Paystub Generator

Generate Pay Stubs for employees and contractors in Arkansas. Enter company and employee details, and our Arkansas paystub generator will automatically calculate the taxes and deductions accurately.

Get Your First Paystub for Free

Need any help to E-File your Returns?

Contact us via call (704.684.4751) or email (support@taxbandits.com). Our team is standing by ready to help you in any instances.